Alternative depreciation system calculator

3000 - 500 5 years 2500 5 years 500 In this example youll be able to deduct 500 a year for. It is determined based on the depreciation system GDS or ADS used.

The Alternative Depreciation System ADS is a method of calculating the depreciation of certain types of assets in special circumstances.

. For personal property acquired after 123198 AMT and the 150 election under MACRS are calculated over regular MACRS lives instead of Alternative Depreciation System lives. Table of Class Lives. Alongside the changes made to asset depreciation classifications bonus depreciation and section 179 expensing the Tax Cuts and Jobs Act of 2017 TCJA brought.

Tangible property used predominantly outside the United States Residential non-residential. The most commonly used modified accelerated cost recovery system MACRS for calculating depreciation. The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets.

Baca Juga

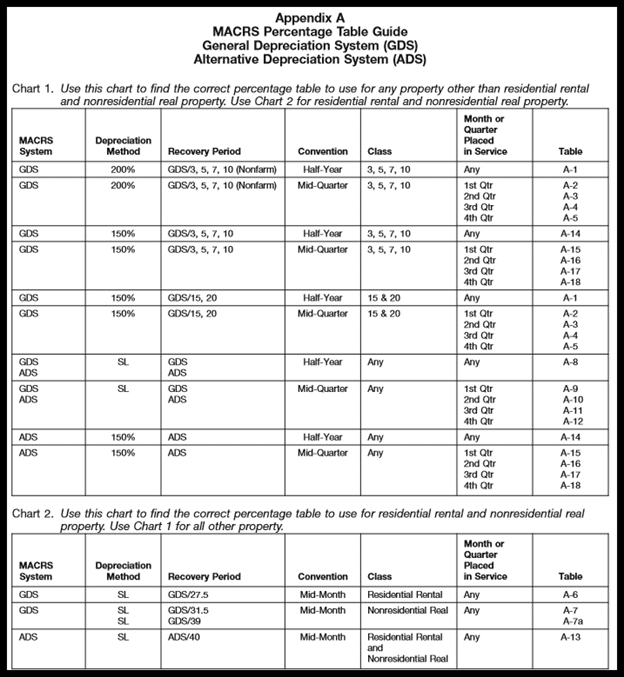

Looking for an alternative to Depreciation Calculator. The most common of these is. Straight-line tables Tables A-8 - A-13 for those using the Alternative Depreciation System ADS including those who must calculate depreciation for purposes of the AMT.

With this system in place you will have to select the most appropriate depreciation method and convention for calculating depreciation on an item. It has a useful life of five years and an expected salvage value of 500. The recovery period of property is the number of years over which you recover its cost or other basis.

The ADS system is required by the Internal Revenue. Ideal for organizations of 201 to 500 employees Depreciation Calculator pricing starts at 34995 as a flat rate as a one-time. General Depreciation System - GDS.

The Alternative Depreciation System is required in the following circumstances. There is an alternative MACRS depreciation system known as ADS under which depreciation is deducted using the straight-line method over generally. The alternative depreciation system ADS is a method that allows taxpayers to calculate the depreciation amount the IRS allows them to take on certain business assets.

First enter the basis of an asset and then enter the business-use percentage Next select an applicable recovery period of property from the dropdown list Next choose your preferred.

Macrs Depreciation Calculator Straight Line Double Declining

Modified Accelerated Cost Recovery System Macrs A Guide

What Is Macrs Definition Asset Life Percentage Exceldatapro

Macrs Depreciation Calculator Irs Publication 946

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator

Depreciation Accounting Macrs Depreciation Modified Accelerated Cost Recovery System Youtube

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Calculator Depreciation Guru Page 3

Alternative Depreciation System Ads Overview How It Works Uses

Macrs Depreciation Calculator Irs Publication 946

2

How To Calculate Macrs Depreciation When Why

2

Costa Mesa Ca Cpa Bizjetcpa

Guide To The Macrs Depreciation Method Chamber Of Commerce

2